Filling out tax paper forms can be a frustrating, complicated, and time-consuming process if you have little or no tax knowledge.

Do you want a quick and easier process for filing your taxes? If so, then your ultimate solution is a tax software.

A tax software automates the tax filing process and helps you to save your time and money as well. The best thing about tax software is you do not need to have any prior knowledge about filing taxes to use it.

Tax software helps you in many aspects and here are some major benefits of having tax software:

- Helps you to keep things organized and provides step-by-step guides.

- You just have to answer some questions and it will automatically figure out which tax forms you need for filing.

- Quickly prepare and file your income tax returns.

- Ensures accuracy and provides error-free tax calculations.

- It calculates the amount of refund for you, how much you owe and how much the government owes.

A wide range of tax software is available with different prices and features.

But the thing is how you will select which one is best for you?

You have to research to figure out the best tax software, but you don’t need to do it. Because we have already done it for you and prepared a list of the 7 best tax software for tax preparers.

All you need to do is continue reading to single out one that best fits your needs.

7 Best Tax Software For Filling Taxes

The best tax filling software provides you with all features that you ever require for filing taxes. Some other factors that make these software best are its easy-to-use interface, cost-effectiveness, and customer support throughout the tax process.

Based on these factors, we have figured out the 7 best free and paid tax software for you. Let’s explore and decide which one best fits your needs and budget.

1. TurboTax

TurboTax is easy to use and allows you to file your taxes with no extra effort. You just have to answer simple questions about you and your life and TurboTax software will do all the work for you.

It will automatically figure out which tax form is perfect as per your tax situation and then it will guide you step by step to file the tax. With TurboTax software, filing taxes is no more a complicated process.

TurboTax uses the latest technologies to check your file from beginning to end and ensures 100% accuracy of your tax file.

It looks at over 350 tax deductions points to find every qualified tax deduction and credit for you. Hence, TurboTax can be the best solution to maximize refund as it offers you maximum refund guarantee.

In case you want to import W-2 or 1099-NEC, then you can easily do it with TurboTax. All you need to do is download the TurboTax mobile application and snap a photo with your phone.

It offers you unique tax solutions as per your needs. Whether you’re a renter, homeowner, self-employed, investor, or small business owner, you can easily find unique tax solutions tailor-made for you with TurboTax software.

TurboTax also offers you a free version that is perfect for only simple tax returns. But for other features, you would have to buy one of the premium TurboTax plans.

Turbo Tax comes with three different premium tax plans: Deluxe, Premier, and Self-employed. Premium plans costs you anywhere from $60 to $120.

If you’re not sure which one is the perfect tax plan for you, then no need to worry.

Go to the TurboTax plans page and select your tax needs. Then it will suggest you right plan for you.

With each TurboTax plan, you will get guaranteed 100% accuracy, maximum refund, and a complete check for a comprehensive review.

- Easy to use interface

- Provide tax solutions for a range of users

- Guaranteed maximum refund and credits.

- Free version available for simple tax filings

- You need to pay only for filing tax

- Limited features come with free plans

- Premium products are highly costly as compared to others

2. TaxSlayer

TaxSlayer is easy, fast, and accurate tax preparation software that comes with the right tools that you ever need for filing taxes.

Using TaxSlayer free mobile app, you can quickly file your tax with ease. In case you face any difficulties while filing, then you can get in touch with the support team via email or phone.

TaxSlayer offers your maximum refund and ensures you will get every dollar back for that you’re eligible. And for the fastest tax refund, it offers you a direct deposit.

In the free plan, you can manage simple tax situations, one federal and one state return.

TaxSlayer offers you three different premium plans: classic, premium, and self-employed.

The classic plan costs you $24.95 and is best for any tax situation. It also covers all forms, deductions, and credits.

Premium plan costs you around $44.95 and gives you access to talk with a tax pro or you can use live chat features for a quick resolution.

A self-employed plan is perfect for personal & business income & expenses and costs you approximately $54.95.

- Plans are quite affordable

- It offers 100% accuracy and maximum refund

- Free customer support

- Basic free version available

- Few additional tax filing options

- Live chat support is only available with the premium plan

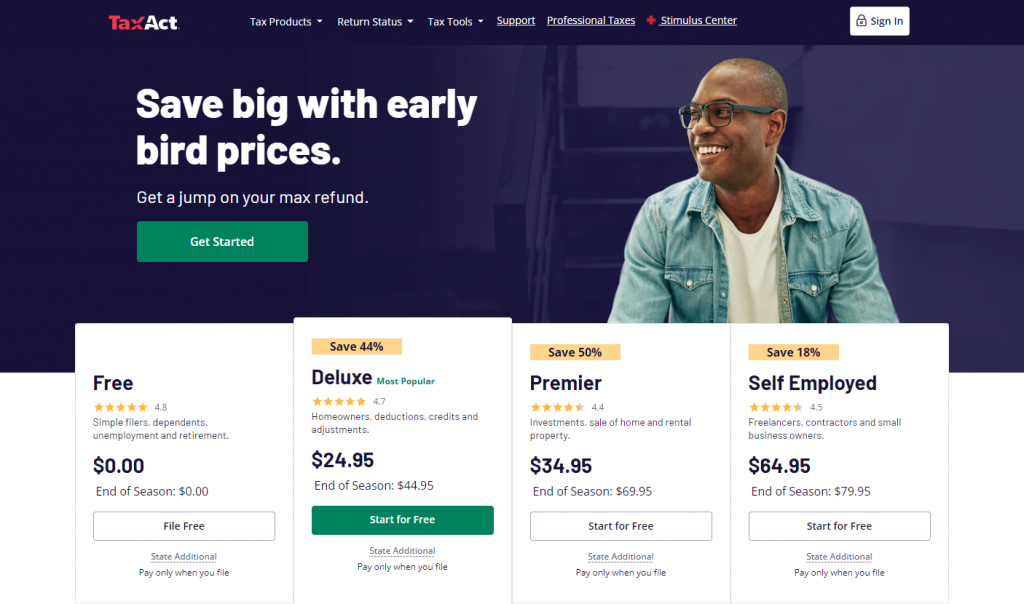

3. TaxAct

TaxAct is the leading provider of affordable tax solutions. Using TaxAct software, you can easily navigate the complexities of a tax at affordable prices.

The TaxAct team holds considerable experience in filing taxes and helped over 80 million federal returns. It provides you with an easy-to-use interface and flexible import options.

Getting started with TaxAct is quite simple and you can quickly import your last year’s return tax report from your previous tax software. It also guarantees to provide you with a maximum refund and a $100k accuracy guarantee.

Its proprietary tool is the perfect solution for deduction maximization and uncovers all qualifying dedication and credits for you.

TaxAct offers you a free plan as well, and it costs you nothing for filing taxes. But with the free version, you will get simple filters and limited features.

If you want more features, then choose one of the pro plans that give you the ability to quickly and easily handle tax filing.

TaxAct provides three pro plans to you: Deluxe, premier, and self-employed, and each plan comes with different features.

Deluxe is the most popular plan and is specially designed for homeowners, deductions, credits, and adjustments. Deluxe will cost you around $24.95 and the best thing is that you have to only pay when you file your tax.

Next is the premier plan that costs you approximately $34.95 and is a perfect fit for investments, sale of the home, and rental property.

If you’re self-employed like a freelancer, investor, or small business owner, then TaxAct provides you special plan called self-employed and costs you around $64.95.

Have a look at TaxAct plans page to figure out which one is a perfect fit for you as per your needs and requirements.

- Easy-to-use navigation tools

- A deduction maximizer tool helps you find every qualifying deduction and credit

- You can use it either online or download it for offline usage

- It provides you with a guarantee for the highest accuracy

- A free version of the software is available

- It provides limited features with the free plan

- It doesn’t provide any audit support

4. H&R Block

The next best tax software on our list is H&R Block, and it is providing leading tax preparation services for all tax situations. H&R Block is the perfect solution for all sorts of taxes, whether it is simple or business. It provides you with many ways for filing taxes and you can choose one as per your needs.

H&R Block provides you with the ultimate control for filing and helps you to maximize your refund. Tax preparation is quite simple using H&R Block software as it provides a flexible interface.

H&R Block provides you with two ways for filing your taxes, such as filing online and filing with a tax pro.

For filing online you can start for free and all you need to do is download a mobile application or use it on your computer. H&R Block will provide you with step-by-step guidance for smooth tax filing.

Next, you can choose to file with a tax pro and for this, you need to pay $69 for getting started. It is the perfect option for you if you know nothing about tax filing as it provides you with a tax pro who will help you with tax filing.

With this plan, you can meet tax pro in the office or via chat, phone or video call. Gather your documents and submit them to the tax pro and he will handle all the steps of tax filing.

H&R Block has approximately 60000 tax pros who hold extensive experience in filing taxes. You just have to review and approve your return and your tax pro does the rest.

- It provides virtual and walk-in support

- Experienced tax pros for filing

- It offers you affordable upfront pricing

- Provides multiple ways for tax preparation

- Limited features with the free plan

- You will get support with only paid plans

5. FreeTaxUSA

FreeTaxUSA is IRS approved e-file provider and filled over 50 million tax returns. It covers all sorts of tax situations and helps you to get the biggest refund.

The best thing about FreeTaxUSA is that it offers free federal with each plan. Using it, you can easily switch between other tax software to import your previous year’s return.

FreeTaxUSA offers 100% accuracy for all tax calculations and to ensure it offers you three-level checking, such as instant check, double-check and final check.

It is safe and secure software, as it uses different mechanisms to keep your personal information and data protected.

Hence FreeTaxUSA is one of the best tax software that comes with multiple features that you ever need for filing taxes and securing your data.

FreeTaxUSA offers you four different plans: basic, advanced, premium, and self-employed. All these plans offer free federal and only you have to pay for the state filing.

And for state filing, it provides you with quite fair prices and you just have to pay $14.99 per state.

In the basic plan, you will get features such as step-by-step guidance and maximum refund.

The advanced plan comes with many advanced features such as homeownership, maximum credits, and deduction, and earned income credit.

All these planes come with several more features and you can single one that best fits your needs and requirements.

- Free Federal with each plan

- Provides accurate calculations as it runs three different checks

- Protect your personal information and data

- Inexpensive prices for state filing

- Supports all major tax situations

- No live chat support

- For audit assistance, you need to buy a deluxe plan

6. Credit Karma Tax

Credit Karma Tax is smart, simple and 100% free tax filing software. If you’re looking for free tax software, then your ultimate solution is credit karma tax.

It provides you with both state and federal tax returns free of cost. It never costs you any dollar, even if you’re taking deductions or credits.

Credit Karma Tax offers you a smart filing process and shows you only those sections that you need for filing as per your tax situation. It also allows you to directly upload W-2 information in case of simple filing.

It offers you 100% accuracy for all tax calculations, despite that, if you need an audit, then Credit Karma Tax provides you with audit defence free of cost.

In case IRS or state tax authority penalizes you due to credit kama tax calculator error, then it will guarantee you to reimburse up to $1000k.

Credit Karma tax also provides you with quick import features that allow you to quickly switch your last year’s return from previous tax software.

Credit Karma Tax is free software and provides you with all features and never comprise even with the return.

It is the only tax software that comes with many features and costs you nothing.

Explore more about credit karma tax software and if it fits your needs, then go ahead and start using it for free of cost.

- Maximize your refund

- The smart tax filing process

- Ensures accuracy for tax calculations

- Free audit support

- Free state and federal filing

- Support a few tax situations

- Limited Technical support

7. Jackson Hewitt

Another best tax software is Jackson Hewitt and holds over 35 years of experience in the tax industry. It will help you with smooth tax preparation and filing.

To make tax filing easy and convenient, it offers you many ways for filing, such as a file in an office, filing online with a tax pro, or filing online yourself.

Decide which way is perfect for you as per your needs.

It has offices in over 60,000 places and you can walk to your nearest office to get expert help. All you need to do is find an office in your neighborhood and file taxes in the office.

Another significant point about Jackson Hewitt is it also works closely with you to resolve your tax issues. No matter you’re facing big and small issues, it will help you to resolve your tax issues.

Jackson Hewitt provides you with customized solutions to address your unique tax problems.

Get in touch with tax pros and tell them your needs and problems and they will offer you one-on-one assistance and to answer all your queries and provide you with a perfect solution.

- Offers multiple ways for tax filling

- Experienced tax pros to get help

- Accuracy, satisfaction, and maximum refund guarantee

- Only allows you to import returns from past Jackson Hewitt’s

- Higher prices for filing with pro or in an office

Conclusion

I hope now will have an idea about the best tax software. A tax software provides a complete set of tools and assistance that you ever need for tax filing.

Each tax software has something unique to offer you and is perfect for different tax situations.

All you need to do is figure out a few answers such as,

What is your tax situation?

What are your specific needs and requirements?

How much you can spend on tax software?

Once you have decided, then you can easily pick the perfect tax return software for you.