Do you want to know how to set a stop loss order on Robinhood?

If yes, you’re in the right spot.

Investors use a bunch of tips and tricks to restrict their losses in the stock market.

Setting up stop-loss orders is one of the ways by which investors can protect themselves from big losses.

If you are a trader, setting up a stop loss is necessary to restrict your losses in this dynamic and volatile market.

Luckily, Robinhood allows traders to set up stop loss orders for stocks and ETFs on their platform.

But the question is: how can you do that?

In this post, we’ll show you how to set a stop loss on Robinhood using your phone or laptop.

So without much further delay, let’s dive in.

What is a Stop Loss?

As mentioned earlier, a stop-loss order helps traders to restrict their losses. When you set up a stop-loss order, it only becomes a market order when the stock reaches a certain pre-determined price.

For example, let’s say you bought a stock at a certain price. If you set up a stop-loss order for 15% below the price at which you bought the stock, you will limit your loss to 15%.

To understand it better, just suppose you bought Tesla shares(TSLA) at $750, and then you also set up a stop-loss order for TSLA shares at $650. Now, if the stock price of TSLA falls below $650, your stocks will be automatically sold at the prevailing market price.

Why Setting up Stop Loss is Super Crucial?

For starters, stop-loss orders help you to limit your losses. In case of a big stock market crash, your stop-loss order will be fulfilled at your decided price, which will result in less loss of your capital.

On top of that, stop-loss orders are free to implement, and you can think of them as an insurance policy for your stocks.

Furthermore, with stop loss, you can easily automate your selling of stocks as the stop-loss order is triggered automatically once the stock reaches the pre-determined price. The orders are fulfilled automatically, and you also do not have to worry about checking the stock prices daily and be concerned about your portfolio.

Ultimately a stop-loss protects you and pretty much caps your risk at a specific level you can set on your own.

How to Set a Stop Loss on Robinhood (iPhone & Android)

Setting up a stop-loss order on the Robinhood app from your smartphone is quite simple. The process of setting up a stop-loss order is pretty much the same as setting up other orders.

Here is how to do it:

Step 1. First of all, launch the Robinhood app.

Step 2. Now scroll down or tap on the graphs icon on the bottom left to open the list of stocks you own.

Step 3. Tap on the stock for which you want to set up a stop loss.

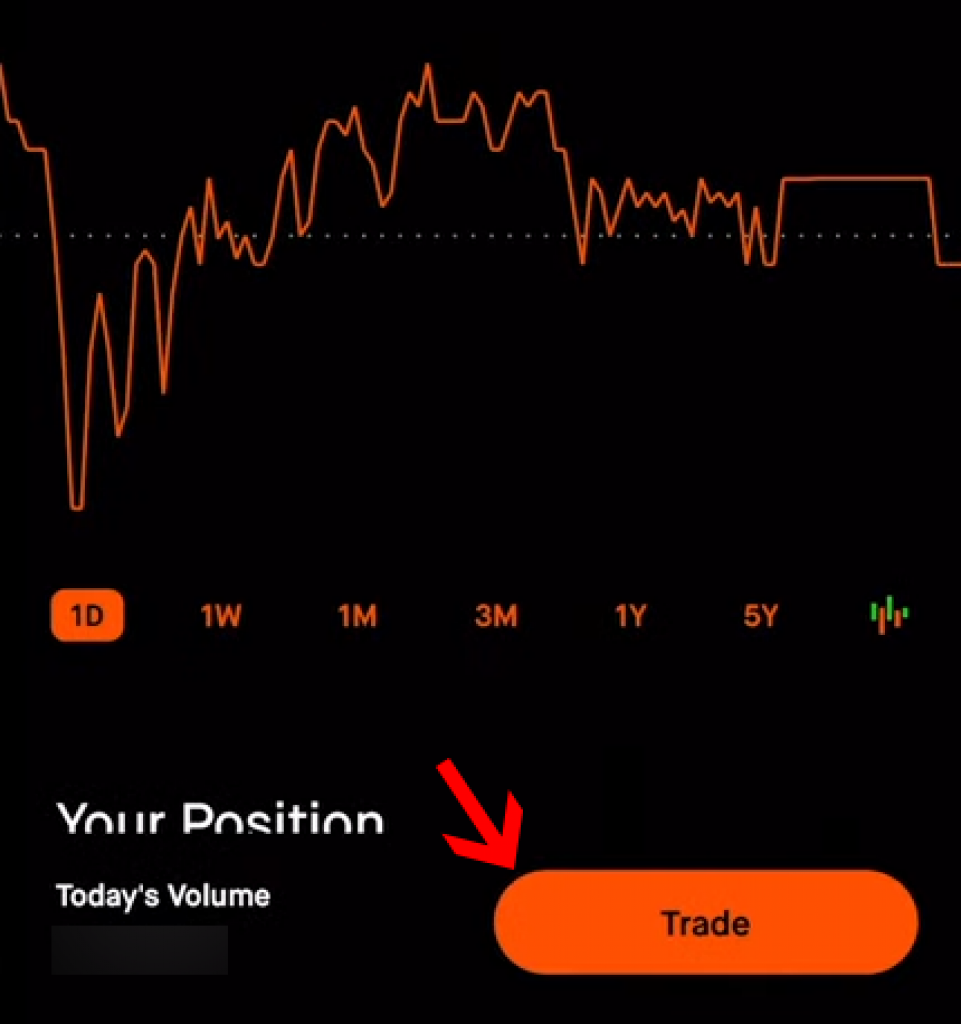

Step 4. You will see all the details about the stock. Tap on the “Trade” button from the bottom right corner.

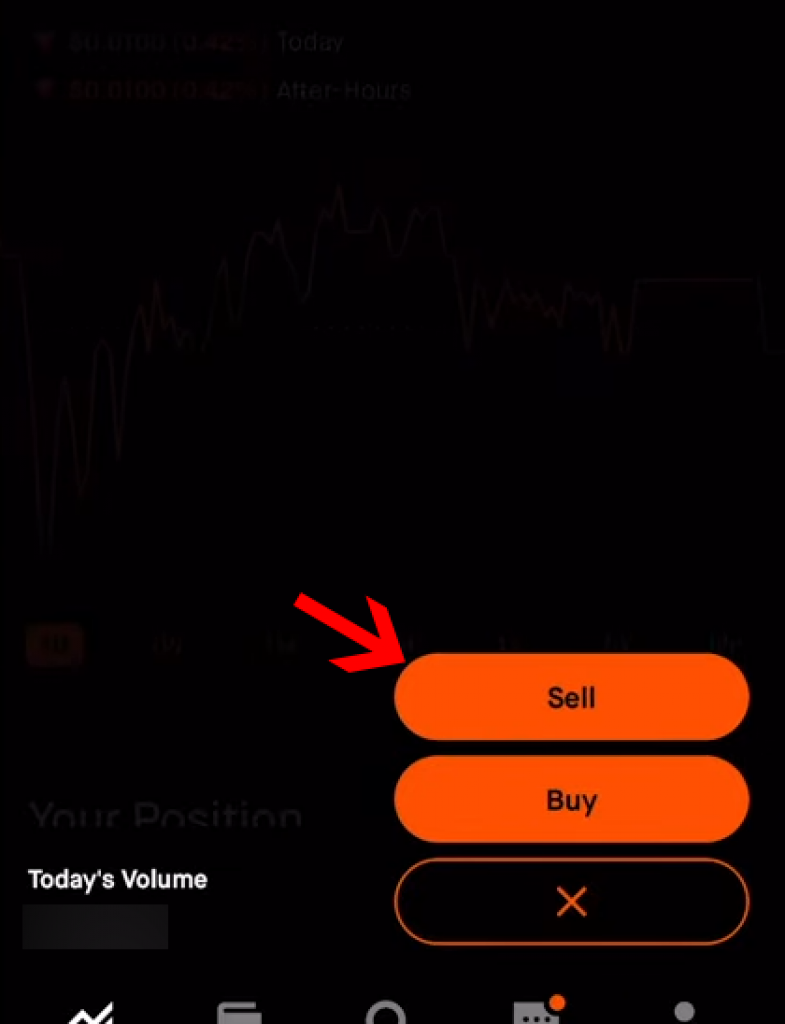

Step 5. Now tap on Sell.

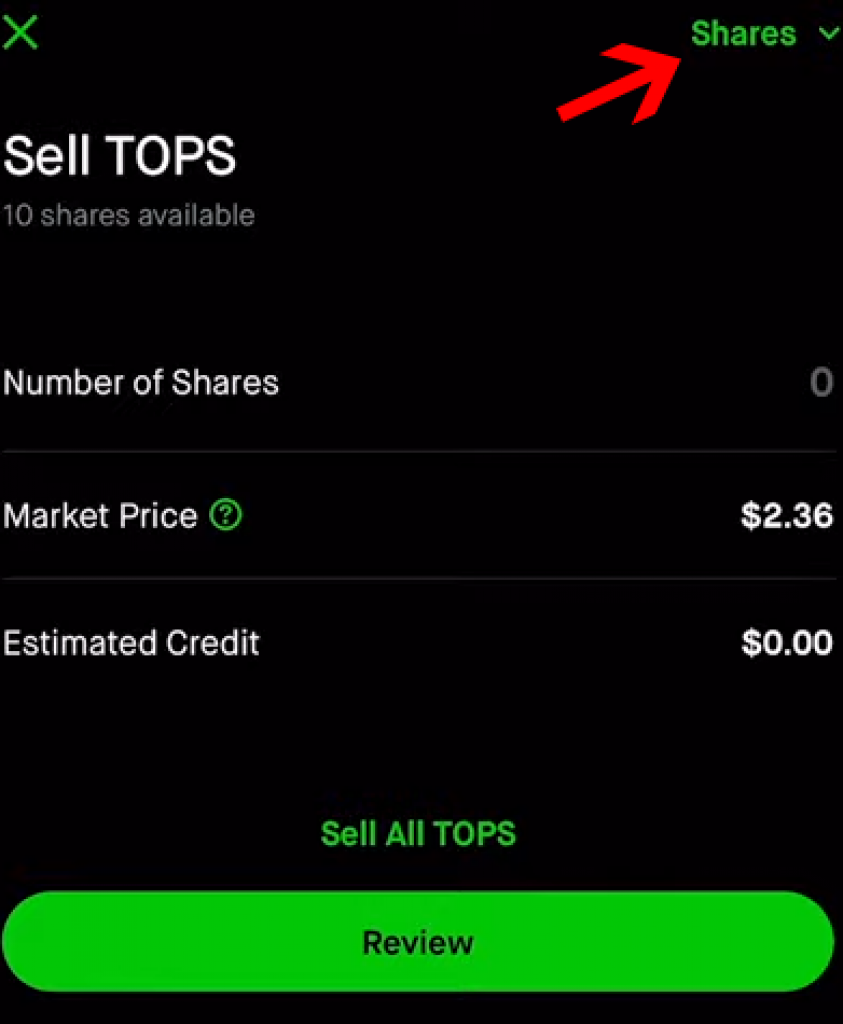

Step 6. Tap on the “Shares” from the top-right corner to reveal the drop-down menu.

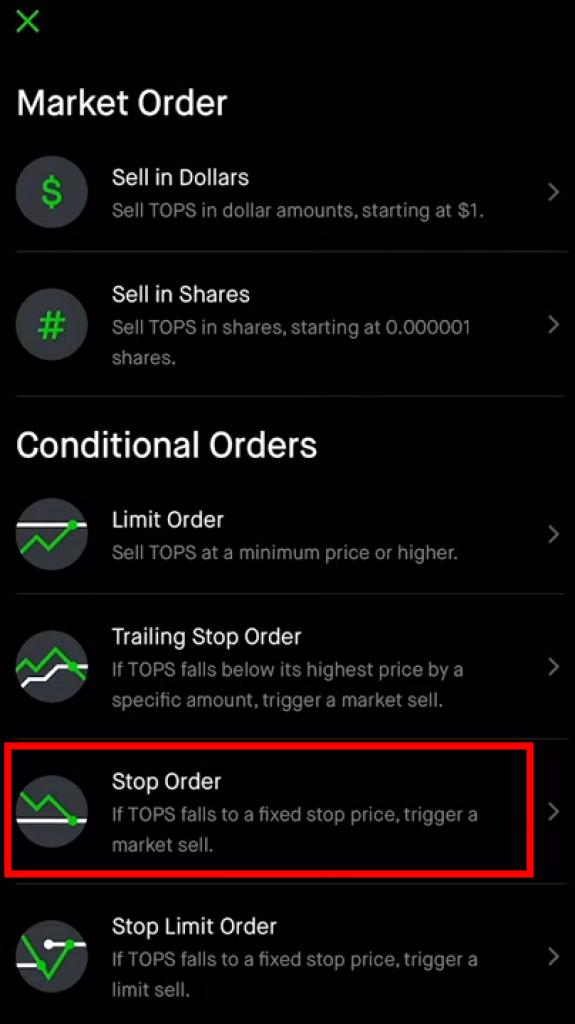

Step 7. Under Conditional Orders, tap on Stop Order.

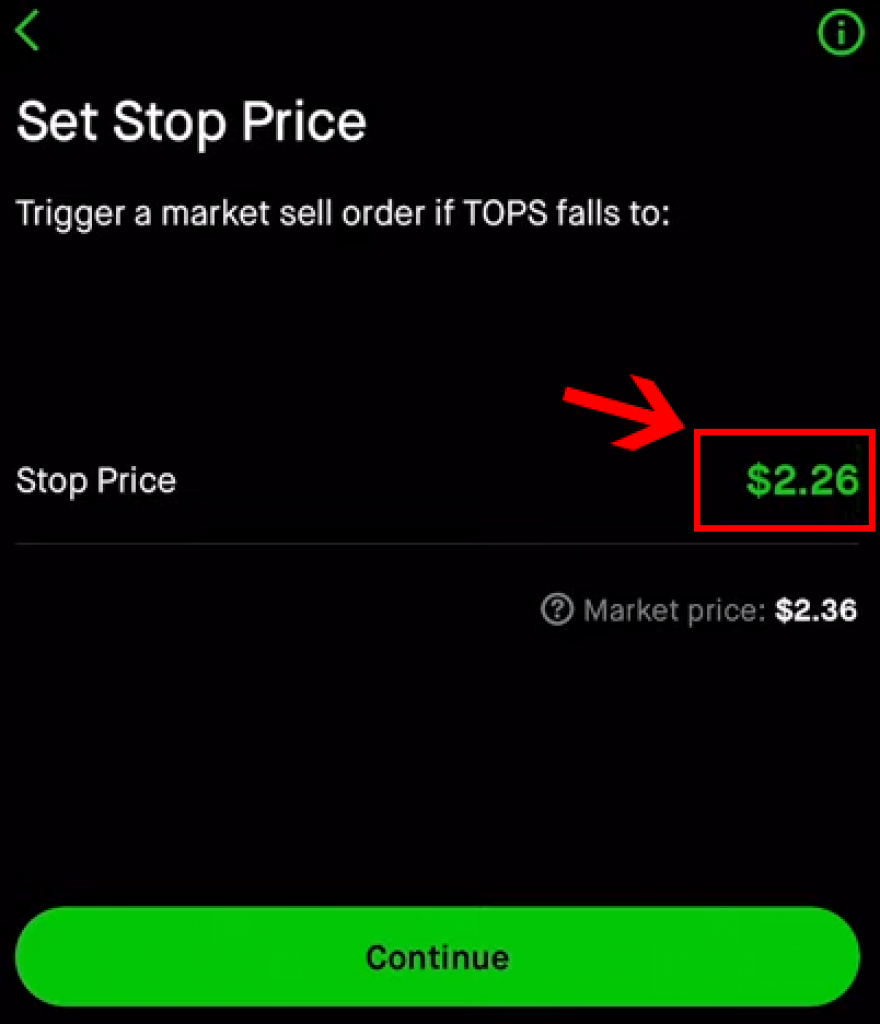

Step 8. Here, enter the Stop price, which should be lower than the current price of the stock.

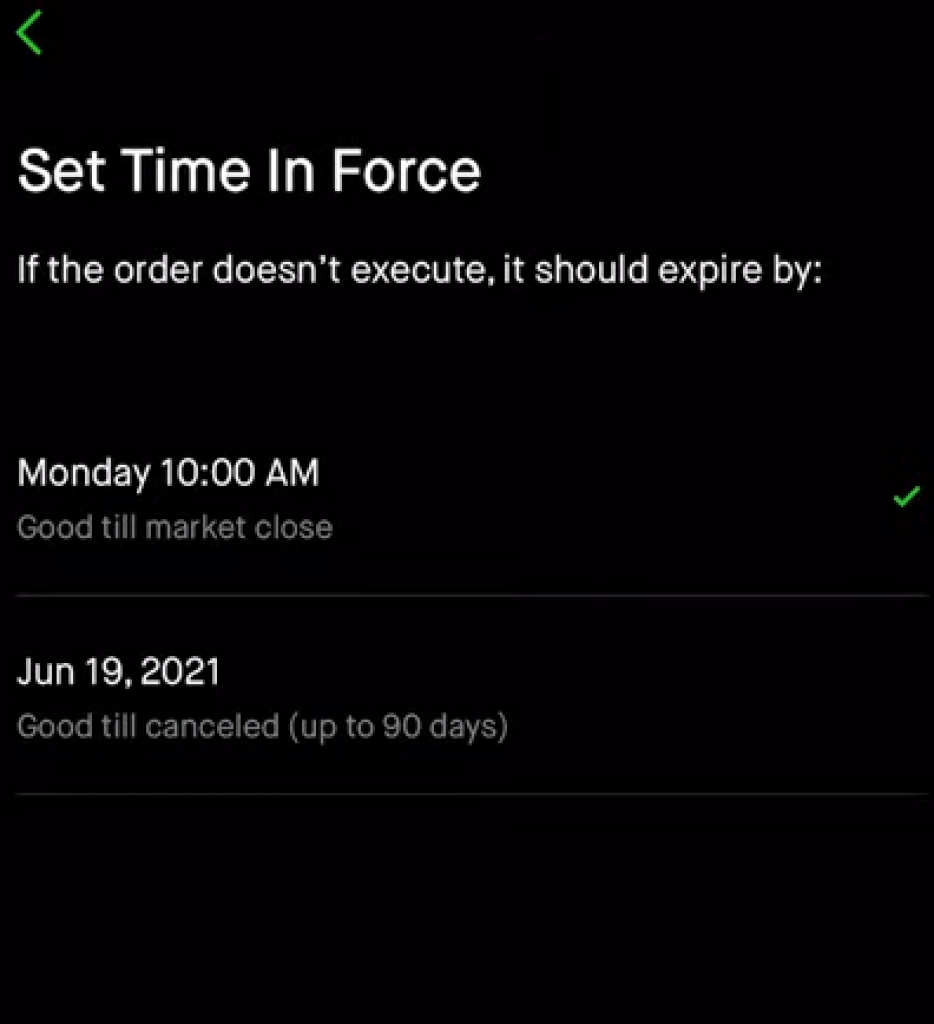

Step 9. If you are a day trader, then you can choose One trading day as the time period otherwise, you can choose 90 days.

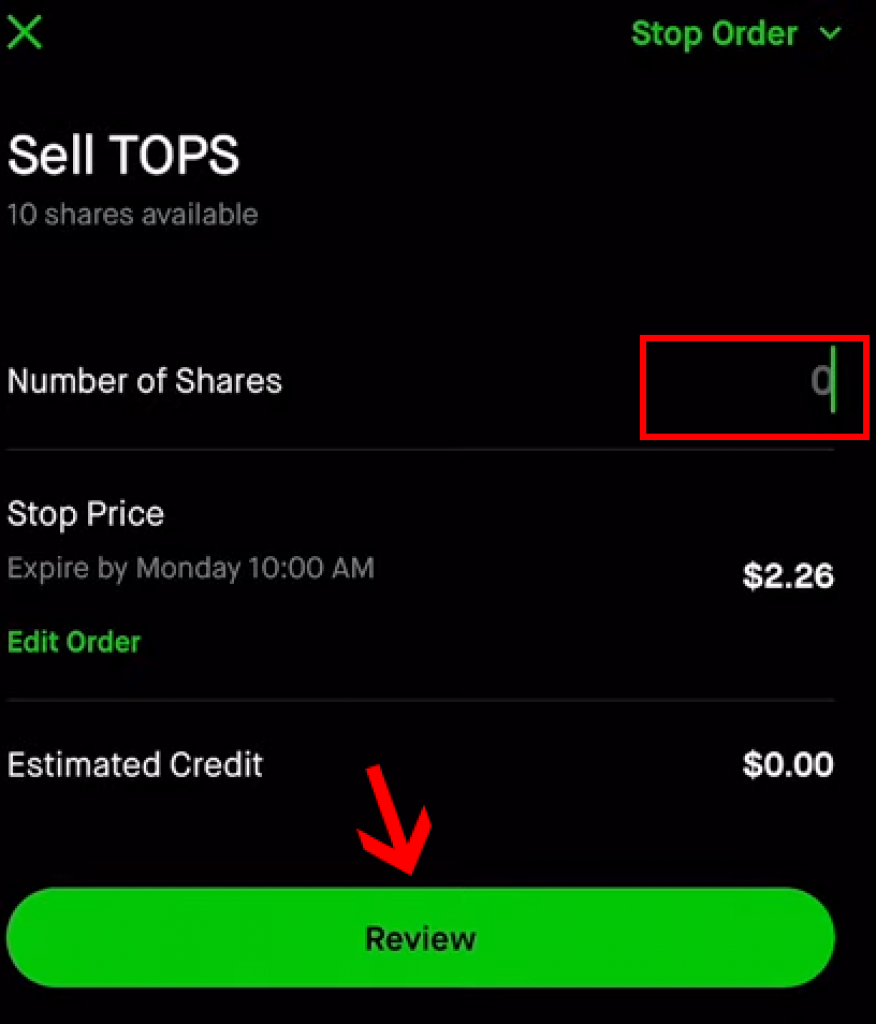

Step 10. Enter the number of shares for which you want to set up the stop-loss order.

Step 11. Finally, tap on Review.

Review the details of your stop-loss order, and you can send the order by simply swiping up, and that’s it.

How to Set a Stop Loss on Robinhood (PC & Laptop)

Although the steps are pretty much the same to set up a stop-loss order on a PC, the interface of the Robinhood web app might be a little different. So here is how you can set up a stop loss on Robinhood on your PC:

Step 1. Open the Robinhood web app on your browser and log in to your account.

Step 2. Open the stock for which you want to set up stop-loss from your Portfolio.

Step 3. Once the stock page opens, you will see all the details about the stock. Click on the down arrow sign next to the Sell option on the right side to open the drop-down menu.

Step 4. Here, change the Order Type to Stop Loss Order.

Step 5. Now set up the Stop Price, which should be less than the current value of the stock. Enter the number of shares for which you want to set up a stop-loss order. Under the Expires column, you can select the “Good for Day” if you are a day trader. But if you are going to hold on to the asset, you should choose the second option, which keeps the order for 90 days.

Step 6. Once all the details are filled, click on Review, and if everything is correct, all you have to do is click on Sell.

That is how you can set up a stop loss on Robinhood on your PC.

Can You Set a Stop Loss on Robinhood After Market Hours?

Although you can place stop-loss orders after market hours on the Robinhood app, they will not be executed on the same day. Instead. They will be queued for the next trading day. So stop-loss orders placed after extended market hours will only be live on the opening of regular market hours on the next trading day.

Can You Stop Loss on Robinhood Crypto?

Robinhood is a versatile trading platform that allows you to invest in all kinds of assets like stocks, mutual funds, crypto, EFTs, etc.

However, the crypto department on Robinhood is overlooked and managed by Robinhood Crypto.

The bad news is that Robinhood Crypto does not allow you to put any stop-loss orders on any crypto assets, be it the ones you already have or the ones you are planning to buy. When it comes to crypto, Robinhood only has market orders and limited order options.

Why Did Your Stop Loss Not Work on Robinhood?

If you have set up a stop-loss order on Robinhood and it didn’t work, then there are a few explanations for it.

Chances are that your order is still pending and did not become a market order. It will be pending until there’s a buyer or seller willing to trade at your pre-determined price. Also, you have to understand that the price that you see on the Robinhood app is not the current price of the shares. Instead, that is the last trade price.

Do Stop Losses Always Work?

Although stop-loss orders are crucial for traders to get protection from a big loss, they do not always work. You see, for the stop-loss order to work, it needs to get fulfilled, and if there are no bids that meet the conditions of your stop-limit order, your trade will not get fulfilled, and your order will be failed.

With a stop-loss order, you set a stop price, and when the stop price hits, a sale is automatically triggered.

But there is no guarantee at which price the sale will occur. So if you want to be safe from big losses, stop loss is vital, but it is not completely bulletproof.

Conclusion

Setting up a stop loss as a trader is crucial as it can protect you from big losses and also automates the selling process for your stocks.

On top of that, it works as a free insurance policy for your stocks. Setting up a stop loss on the Robinhood platform is seamless, and you can do it from both your mobile and your PC.

Just make sure that you know pretty well about the stock for which you are setting up stop-loss orders.

Also, remember that stop-loss orders can protect you from big losses, but they are not entirely bulletproof.